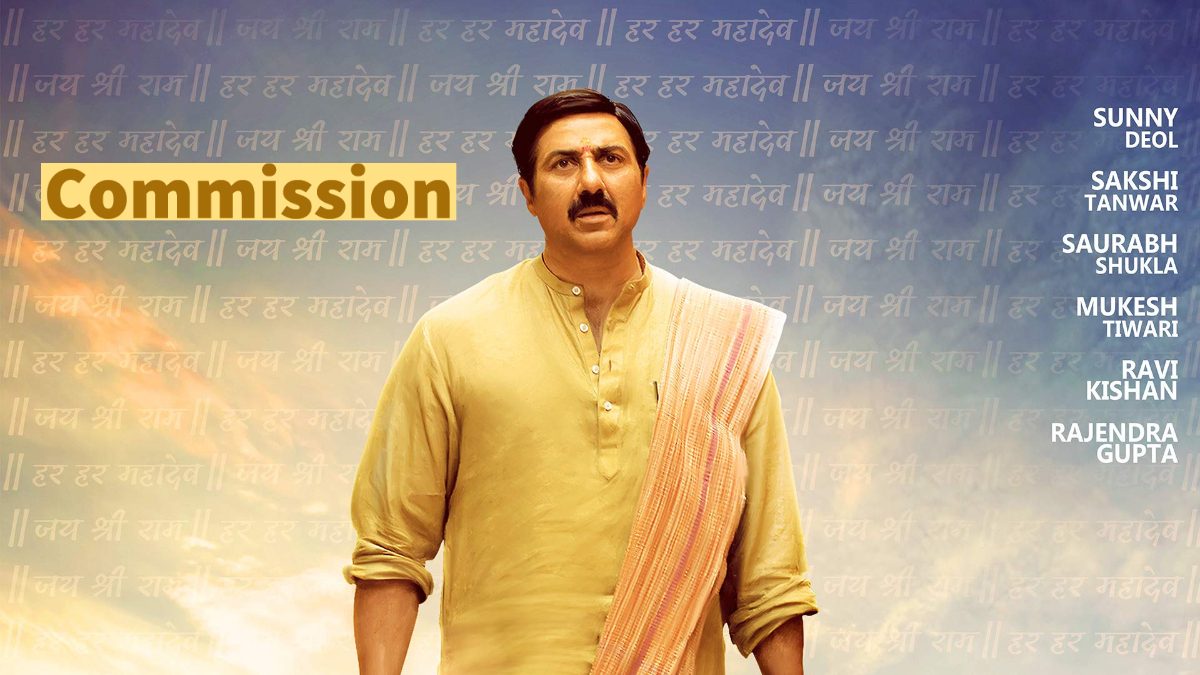

Movie Case Study

The scene shows a conversation between a broker (played by Ravi Kishen and a client. The client wants to rent out his place to locals. The broker demands a double commission for this job while the client says that he can pay a single commission.

Learning Perspectives blog will explore the meaning of commission.

What is Commission?

The commission is a charge that is taken by the middleman in a transaction. It can also be referred to as part payment. This can be in terms of a flat rate or a percentage. Commissions are generally charged by brokers, consultants, and financial advisors. Brokers charge either a fixed or a graduated commission. Brokers are seen in many areas, the most popular ones are real estate and share markets. Commissions are popular amongst sales employees too.

Similar to the scene that you saw, the broker would get let’s say 5% of Rs. 10,000 which is the rent. Half from the owner of the flat and half from the tenants.

Many small businesses hire sales employees on a commission basis. For example, A salesperson would get a 10% commission when he is able to sell 3 products. This is based on the number of products sold by the salesperson. That means a salesman only earns when he sells products. Another way to refer to this is performance commission.

Many investment and financial advisors earn in the same manner. The more investment plans and instruments they are able to sell, the more commission they earn. Think of LIC policies, mutual funds, and saving plans, the more they sell, the more commission is earned by that advisor for the company.

Types of Commissions:

There can be many types of commissions. They are charged by both employees and self-employed individuals. A salesman would receive commissions from the company they work for while a self-employed individual would charge a commission from their clients.

Advisors and brokers charge fees instead of commissions. This is a flat fee rate for their clients. A salesperson, however, would receive a commission on the sale they make. Commission can be based on the following aspects:

The commission Percentage will increase if there is a higher profit on a sale.

A preset commission is based on the number of sales an employee makes.

Commission would keep increasing as more sales are made for the product or the service.

Advantages & Disadvantages of Commission:

Receiving commissions makes the individual work dedicatedly. If an individual’s compensation structure is commission based then the individual is highly motivated to bring in the numbers for the company. This can sometimes backfire too as the individual may adopt methods to earn a commission.

Understand Commission with a Video

Working in a team with a commission-based pay structure again can be both beneficial and disadvantageous. Team players can bring in healthy competition but sometimes it can create toxic work environments.

Costs of Commissions

The cost of commission is the charge that is taken by the middleman or the broker. In the share markets, there are two types of brokers namely full-service brokers and discount stock brokers.

Full-service brokers, as the name suggests charge for all the services for trading & investing in the stock markets. They offer services such as advice, research, and trading on the client’s behalf. This means they charge higher brokerage compared to the discount stock brokers who are online brokers for stock trading.

For example SBI securities (broker) charge 0.05 for cash trading and 0.01 for futures trading. They also charge brokerage at the time of account opening. A real estate broker charges 2% of the transaction value when selling properties. This is the cost of commission.